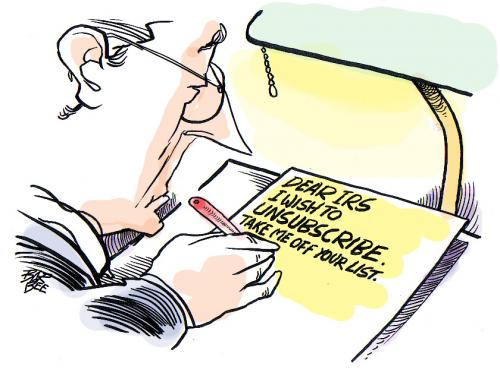

Do you wish the IRS would remove you from their federal tax levy list? Do you continue to get federal tax levy notices from the IRS? Do you receive other notices from the IRS and want a chance to unsubscribe? There are several notices the IRS sends out to delinquent taxpayers and each notice is relevant in some way. First piece of advice we are offering is to open and read each and every notice. The first mistake taxpayers make is not opening and reading the mail. The mail will give you instructions on how to proceed. Mostly the notices are intended to catch your attention with words such as "Notice of Intent to Levy", "Federal Tax Levy", "Notice of Levy", "Notice of Seizure", "Notice of Balance Due", etc. Secondly, there are specific timelines to be adhered to with each notice. Therefore, if you have received any of the notices mentioned, especially a notice related to an federal tax levy, pay attention, read the notice, and consult with KW & Associates, Inc.

The most important notice referencing a federal tax levy is the "Final Notice of Intent to Levy". The particular notice comes with both a 30 day timeline giving the taxpayer the ever important appeal rights. The notice usually arrives certified and you must sign for it. The Final Notice of Intent to Levy is important for the reason it is your last and final warning prior to a federal tax levy being issues against your bank accounts, accounts receivable, or wages. If you have received a final notice please contact us immediately. Further, if an appeal can be filed within the timeline appropriated, time will be granted to pursue resolution.

Lastly, if you haven't been able to respond to the Final Notice of Intent to levy, be assured a federal tax levy will be issued. A federal tax levy will freeze your assets, monies, bank accounts, wages, and keep you from being paid. If the IRS has gone this far, they are willing to go further as the next step would be actual seizure of real property assets, vehicles, etc. When a federal tax levy is issued, its time to take action. Don't sit and wait for the IRS to do anything, as the IRS will not take any action to release the levy. The IRS will simply wait to collect the monies owed to them. In fact, the IRS will continue to issue federal tax levies until your account has been paid in full.

If you have started to receive final notices indicating a federal tax levy will go out, or you have been levied please contact us immediately at 720-398-6088 or check out our website at www.highlandtaxresolution.com.

No comments:

Post a Comment