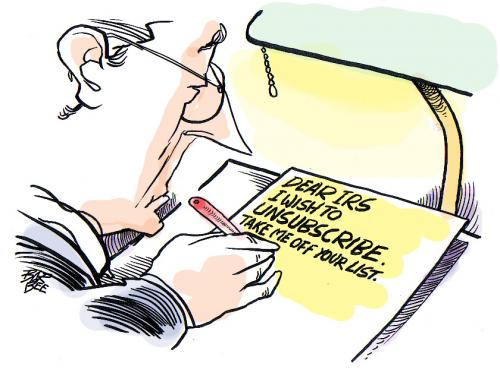

Most businesses look for the IRS to refund monies by way of a tax assistance program. Other businesses that may owe taxes look for taxes to be lowered. However, when we you are taking a look at the real benefits of owning a business, the tax assistance programs lie within the business deductions themselves. The article below titled (10 Tax Benefits for the Self Employed) points out the real benefits of owning your own business. After all, who wants to pay the IRS MORE money than they did last year right?

Some of my favorites include:

- The Home Office Deduction - One of the more common tax assistance program deductions taken; don't forget to map out your home to get full credit for the space used. And remember the burden of proof is on the taxpayer, so be sure to keep accurate records of every penny spent.

- Meals and Entertainment - Another very common tax assistance program deduction taken falls under meals and entertainment; keep meticulous records, who was the meal shared with, for what purpose, what was discussed, etc. Remember, the deduction is limited to 50% and can become a red flag for an audit. As long as your meals and entertainment expense isn't over half of your gross income you should be fine.

- Education - Continuing Education, Continuing Legal Education, and Continuing Professional Education all qualify as another tax assistance program that is tax deductible. Schooling for your profession is also allowable, however all courses taken must relate to the profession, or relate to a degree program mandatory for the profession or job. Keep receipts, keep educational material, and keep anything relating to the course to prove it relates directly to your profession.

Remember, the IRS doesn't have to give you a refund, settle on the taxes you owe, or promise to lower taxes for you to qualify for a tax assistance program.

http://www.investopedia.com/articles/tax/09/self-employed-tax-deductions.asp

Check out our website at www.highlandtaxresolution.com for more information! Or, feel free to call us directly at 720-398-6088.